I f you want first time home buyer tips, you’ve come to the right place.

f you want first time home buyer tips, you’ve come to the right place.

f you want first time home buyer tips, you’ve come to the right place.

f you want first time home buyer tips, you’ve come to the right place.

Buying your first home is an exciting time, but the financial lingo can get overwhelming. Fear not, though. After reading this guide, you’ll be well on your way to becoming a first time homeowner.

After all, people become first time homeowners every day, and you can absolutely learn all of the information necessary to be a part of that club. In fact, I think you’ll find that everything is more straightforward than it seems.

To help you in the process, below is a comprehensive guide for hopeful first time homeowners. It lists nine steps to take so you can eventually buy your first home successfully. You’ll learn how much house you can afford, how to get pre-approved for a loan, how to find a buyer’s agent, and even tips for ensuring you’re able to keep your home long after moving in.

Let’s get started.

Step 1: How Should I Financially Prepare for Buying a House?

Before you even consider where you want to live and how much house you can afford, you should financially prepare for buying a house first. If you’re a first time home buyer with bad credit, this is the most important step you can take in this process. This section shows you how.

Pull Your Credit Report

As a first time home buyer with bad credit or good credit, you’ll want to pull your own credit report to know where you stand.

You can look at your credit report from each of the three main credit bureaus for free once a year. Go to AnnualCreditReport.com, fill out the required information to confirm your identity, and then take a look at your report. The main issues you want to fix are adverse accounts. You’ll see those listed near the top of the credit report.

Even if you think your credit history is squeaky clean, check your credit report anyway. There could be a mistake on it. Once, I found an adverse account in collections on my credit report from the public library for not returning an audiobook I borrowed for a long drive.

So, even silly, seemingly inconsequential mistakes could be on there. Lenders don’t like to see borrowers with adverse accounts or any accounts in collections, so be sure to resolve those before talking to a bank about a home loan. An easy way to challenge the information on your credit report is through a service like Credit Karma.

Improve Your Credit Score

Your credit report also provides valuable information that can help you improve your credit score. Here are the factors that affect your credit score:

| Payment History | 35% |

| Amounts Owed | 30% |

| Length of Credit History | 15% |

| Credit Mix | 10% |

| New Credit | 10% |

With this in mind, you now know that your payment history plays a huge role in your credit score. This is the record of all the bills you’ve paid on time, and banks love it when you pay on time because it means they will likely get paid on time if they loan you money.

If you have late payments on your credit report, the best plan is to pay all your bills on time, every time from now into the future. Your late payments over 30 days will remain on your credit report for 7 years, so you can’t go back and erase those. However, you can ensure all your recent bills show current payments with accounts in good standing.

Be prepared for your potential lender to ask about any late payments. I had a late payment that was 5 years old on my credit report, and every lender I talked to about my first home loan asked me about it. I explained that it was an oversight and as evidenced by the rest of my record, not typical of how I handle money. They seemed satisfied with that response, and we were able to get a home loan without too many problems. So, even if you have late payments on your credit report, that doesn’t mean that you won’t get a home loan.

Don’t Take Out New Loans

Once you start the home buying process, avoid taking out new loans. I know part of your credit score relies on a good account mix, but this is not the time to add new accounts to your report. Taking on new loans, even if you can technically afford them, can affect your credit score and your debt-to-income ratio, or DTI.

So while you’re in the middle of checking your credit, getting pre-approved, and seeing how much home you can afford, you are better off not taking out any new car loans or applying for new credit cards.

Eliminate High-Interest Debt

Another quick way to improve your credit score is to pay down any outstanding debts you may have. The amount of money you owe in relation to your credit limits makes up 30% of your credit score. If you’re maxing out your credit cards and using up most of your available credit, you’ll have a lower score. So, before applying to lenders for a home loan, try to pay off as much consumer debt as possible to improve your score.

If you need to find a way to get extra money so you can pay down debt, either cut back on your expenses or earn more money. If you feel like you’ve cut back on as many expenses as you can, the next step is to pick up a side gig to make more cash. Here are a few examples of ways you can earn extra money so you can become a homeowner sooner:

- Rent out a room on Airbnb.

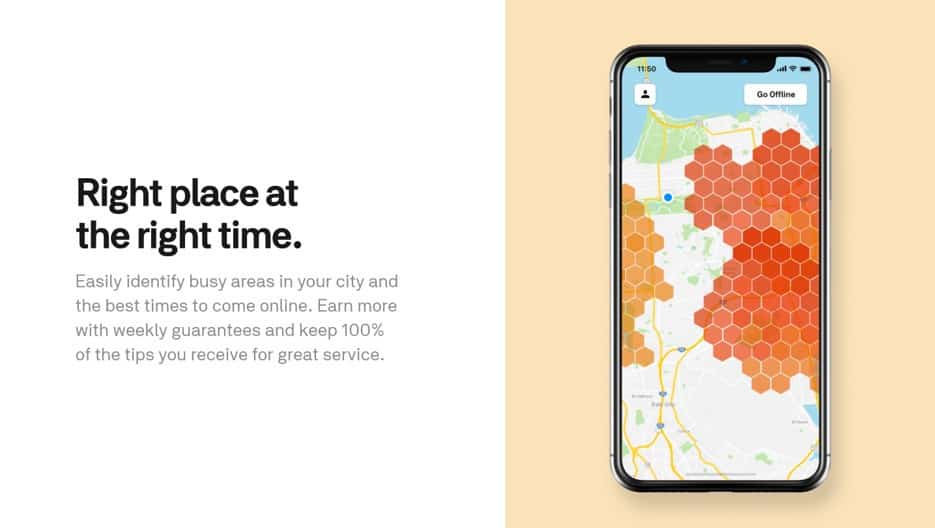

- Deliver groceries with Instacart.

- Deliver take out with Uber Eats.

- Start an online business.

Set a Monthly Savings Goal

Once you’ve pulled your credit report, repaired adverse accounts, and worked hard to pay down outstanding debt, it’s time to set monthly savings goals. You’ll need a large down payment, preferably 20% of your home purchase price, and enough money for closing costs in order to buy a house.

In order to stay motivated to save money every month, put a picture of your dream house on the fridge. Set reminders. Work together with your spouse as accountability partners so you can reach your goal of homeownership together. If you’re single and buying a home, get accountability through your parents, coworkers, or friends. Usually, a combination of eliminating unnecessary spending and finding ways to increase your income can help increase your monthly savings goals.

As far as where to keep your monthly savings goal, I recommend depositing it in a high yield savings account (as opposed to investing it). That way, the money is tucked away earning some interest while you save to buy your home. Investing is a good idea for long-term goals, but for short-term goals, like buying a house within a year, a high yield savings account is preferable to the stock market.

Step 2: How Much House Can I Afford?

Banks often approve people for a more expensive house than they can afford. So, the most important lesson here is that you are the one who should decide what you can afford (not the bank.) So, how can you figure that out? Use the rules below.

28% Rule for Mortgage Payments

The 28% percent rule means that your mortgage payment should be 28% of your gross monthly income or less. Some financial experts actually recommend that it should be 25% of your monthly income or less.

Keep in mind that your total income is your gross income for both spouses combined (if you’re buying a home with a spouse.) Gross income is your income before taxes, health insurance, and other expenses get deducted from your paycheck. Net income is your income after those expenses have been taken out.

If you live in a higher cost of living area like the New York city metropolitan area or in parts of California, this percentage might be higher. Keep in mind, though, that the goal is to not overextend yourself. By sticking to the 28% rule, you will have a house payment that’s manageable with your gross income.

32% Rule for Total Housing Costs

The 28% rule mentioned above applies just to mortgage payments, but there are more costs to consider when buying a home. For example, you’ll have to pay homeowner’s insurance, and if you put down less than 20% in a down payment, you’ll likely have to pay for private mortgage insurance too.

The 32% rule says that all of these payments combined – mortgage, PMI, and homeowner’s insurance – should not exceed 32% of your gross income.

40% Rule for Total Monthly Debt Payments

Lastly, if you have other debts you’ll still be paying as a homeowner, like student loan debt, credit card debt, or a car loan, stick to the 40% rule. This rule says that all of your debt payments in total, including your house payment, should be no more than 40% of your total income.

While these percentage rules aren’t set in stone, they provide good guidelines to ensure you can afford not only your mortgage payment but your other bills too. That’s why it’s so important to have an intimate understanding of your finances before you even look for your first house to buy.

Buying a home isn’t a quick process, but it is a worthwhile one. If you can get your finances organized, manage your debt, and improve your credit score, you’ll be ready to move on to step 3, deciding where you want to live.

Step 3: Where Do I Want to Live?

One of the first questions you need to ask yourself when buying a home is, “Where do I want to live?” It might seem like you already have the answer or even know the exact neighborhood you prefer. Yet, it’s important to keep an open mind when you’re buying your first home.

What to Know About Desirable Neighborhoods

Sometimes, highly desirable neighborhoods also have high markups. You might be surprised to find an equally beautiful neighborhood that’s up and coming just 15 or 20 minutes away from where you think you want to live.

If you’re set on living in a certain neighborhood, consider buying the least expensive house in the neighborhood. If you have DIY skills or are willing to invest more in your home over time, you could increase the value of an older home simply by updating it.

Consider School Districts

If you have children, carefully research school districts. You don’t want to think the house you’re buying is squarely in the district you want only to realize later that it isn’t. Also, every school district is different. Some allow you to go to any school within the district while others only allow you to go to the school closest to your specific neighborhood. It’s important to know that information ahead of time.

If you’re a newly married couple and hope to have kids a few years into the future, consider homes that are further out from your desired area. Specific neighborhoods near good school districts might be highly competitive for a first time home buyer.

If you don’t have kids yet, it might be wise to buy a less expensive home, build equity, and then move into a specific district once you have a family. After all, kids don’t start kindergarten until they’re around age 5.

How Long Do You Want to Live There?

Buying and selling homes can get expensive. There are closing costs, real estate agent fees, and moving costs to consider. It’s not something you should do every year or even every few years because of these expenses. Ideally, strive to live in a home for at least five years before you consider selling it. This allows your home time to appreciate in value before you sell.

So, when you’re thinking about where to live, consider how long you want to live there and what your future family might look like in that home as well.

Step 4: How Much Do I Need for a Down Payment?

Saving for a down payment is an important part of the home buying process. It takes discipline to save several thousand dollars for this purpose, and the more you save, the bigger percentage of your home you will own. A first time home buyer down payment isn’t any different from an experienced home buyer down payment.

Here’s what you need to know about the first time home buyer down payment.

Most Lenders Prefer 20%

If you want to qualify for a conventional mortgage, lenders prefer that you put 20% down on a home. So, that means if the house you want is $200,000, you should save $40,000 for your down payment. Keep in mind your down payment doesn’t cover other costs associated with closing on your home. You’ll still need to save additional money for the inspection, closing costs, and realtor fees.

Put as Little as 3.5% Down with an FHA Loan

First time home buyer loans with zero down are almost unheard of, but the FHA is probably the closest you’ll get toward your goal if you can’t afford much.

If the thought of saving 20% down for a home overwhelms you, there are other mortgage options. If you qualify for an FHA Loan, which is a common option for a first time home buyer loan, you can put down as little as 3.5% to purchase your home. Keep in mind, though, if you only put down 3.5%, you might be subject to a higher interest rate as well as PMI.

PMI

PMI, also known as private mortgage insurance, is an additional bill you have to pay if you put down less than 20% on a home. This isn’t money that goes towards paying down your mortgage loan, though. It is an insurance payment that you make. Because you put down less than 20% on your home, the bank considers you a riskier borrower. The insurance protects them should you ever foreclose on your home.

VA Loans

If you served in the military, you might be eligible for a VA loan. VA loans are a different type of loan because you can buy a home for $0 down without having to pay PMI. The reason is that a portion of each VA loan is backed by the federal government. There are fees and potentially higher interest rates with a VA loan, though, so it’s important to compare the pros and cons of a VA loan versus a conventional mortgage before deciding which is best for you.

First Time Home Buyer Programs

Because this is your first home, it’s important to see if you qualify for first time home buyer programs. I already mentioned the FHA loan program and the VA loan program above, but there are others, like the HUD Good Next Door Neighbor program, which helps teachers, firefighters, police officers, and other personnel buy their first homes.

There are also other first time home buyer benefits, like grants, that you can apply for. You can find first time home buyer grants by talking to your real estate agent or brokers, because many of these grants are state-specific or income-specific. You can also look online to see what grants might be available to you in your area.

Don’t Forget About Closing Costs

As mentioned, you’ll also need to save for closing costs. Some buyers do ask the seller to pay for a part or all of closing costs during the sale, but you shouldn’t count on this. Instead, speak with your real estate agent to get an estimate of closing costs. By law, they are required to give you the exact amount you have to pay in closing costs a few days before your closing date.

Beware of Wire Fraud

In the days leading up to your closing date, you’ll get information about where to wire your money for closing. Over the past few years, there have been numerous reports of wire fraud. Hackers can break into your real estate agent’s email, and instruct you to send your money to a completely different account. Once you wire money to the wrong account, it’s very difficult to recover it. Make sure to call your real estate agent before wiring to confirm the correct account numbers over the phone before sending it.

Tax Credits and Deductions

In your research of first time home buyer benefits, you might come across information on first time home buyer tax credits. That’s usually referring to the federal tax buyer credit that President Obama created during the 2008 recession and housing crisis. Unfortunately, that tax credit is not available anymore to new homeowners.

However, you can deduct the interest you pay on your mortgage on your taxes as well as several other costs, like moving costs. Once you become a homeowner, it’s important to research any change in tax law as it relates to owning a home or consult an accountant to ensure you’re getting the biggest tax benefit possible after buying a home.

Step 5: Get Pre-Approved for a Loan

As evidenced by this list, it might take some time to financially prepare to buy your first home. It could take a few months to pay down debt, save money for your down payment, and more. However, this is time well spent because you’re much more likely to get approved for a home loan if you have a high credit score, ample savings for a down payment, and know exactly how much house you can afford. Also, the better your credit outlook, the lower interest rate you’ll get most likely.

Pre-Qualified vs. Pre-Approved

You might have heard two terms when it comes to getting initial bank approval for a home loan, pre-qualification and pre-approval.

Pre-qualification is where you submit your financial information to a lender, either over the phone or online, and they can give you an approximation of the price of a home you can afford based on your information or credit-worthiness. This is not a guarantee for a loan; it’s more of a snapshot to let you know where you stand.

If you do not get pre-qualified based on your financials, you know that you have to go back, work on your credit, increase your down payment fund, and more. If you do get pre-qualified, you can feel comfortable beginning your search for a buyer’s agent. Eventually, you will need to get pre-approved which is different from pre-qualification.

Requirements for Pre-Approval

Pre-approval is more official than pre-qualification. You’ll be submitting actual documentation to the bank to confirm the numbers you gave them during pre-qualification are accurate.

Here is a list of documents your lender will likely request during pre-approval.

- Proof of Income

- Proof of Assets

- Employment Verification

- Identification Documents

- Social Security Numbers to Run Credit

Your lender will take all of these documents, verify everything, and then they might ask you a few questions. Sometimes they’ll ask you to explain past credit mistakes or ask you to show past employment data. If you’re self-employed like I am, you will likely have to show two years of profit and loss statements from your business. If you haven’t been in business for two years yet, you might have to delay the homeownership process until you can prove you have a steady income.

After your lender reviews these documents, you’ll get an official pre-approval letter. This is important because it shows you’re serious about homeownership. Additionally, some listing agents might not let buyers view a home without this pre-approval letter. This helps them not to waste time showing a house to a potential buyer who might be denied a loan after making an offer.

Step 6: Find a Buyer’s Agent

Finding a good real estate agent is integral to buying a home. You want someone with experience, patience, and a willingness to help you through this process.

Keep in mind that not all real estate agents are Realtors. A Realtor is a special designation that real estate agents can get for being members of the National Association of Realtors, which has a strict code of ethics they must abide by. Here are a few ways you can find a real estate agent or Realtor.

Word of Mouth

Start your search by asking friends and family members for recommendations of real estate agents in your area. Listen to why they recommend them. Is it because they got them a good deal? Is it because they carefully explained the process? You want to find an agent who will help you through this process since it’s new to you.

Online Search

Some of the most popular websites to find real estate agents are Realtor.com, Redfin, and Zillow. Make sure you read all the reviews to make sure the person you want to work with is responsive and knowledgeable about your area.

Buyer’s Agents vs. Listing Agents

Again, when you’re buying your first home, you’ll be looking for a buyer’s agent. You might see listing agents come up in your search. Although real estate agents can do both, sometimes they specialize in one or the other. A listing agent is an agent who lists your home for sale. They’ll be responsible for helping you price the home, inviting buyer’s agents to come to open houses, and more. A buyer’s agent, on the other hand, works just with you – the buyer – to help you through the whole home buying process.

Step 7: Find a Home You Love

Now that you’re pre-approved for a loan and have a buyers agent, it’s time for the fun part: finding a home you love. A simple first step would be to start going to open houses in the neighborhoods you love or looking online.

Research Homes Online

Your real estate agent might give you access to a private portal that shows you homes that match the criteria you want. You can continuously refresh this portal to find the newest homes for sale in your desired neighborhoods. This is especially beneficial if you’re in a competitive housing market where homes go quickly.

Visit a Lot of Homes

Your buyer’s agent will probably ask you for a list of the things you want in a home. You might not be able to get everything on your list, but it will give your agent a good idea of what you’re looking for.

As you visit homes, you might see other things you want or realize that you don’t actually need a fireplace or a large backyard like you thought. The more homes you visit, the more you’ll discover the right type of home for you. Keep the communication with your real estate agent friendly and open, so they know if your preferences change.

See Beyond the Decor

When you visit an open house, try not to get distracted by the decor. You shouldn’t walk into a living room and say, “Oh I love the furniture,” because the furniture is not yours. Instead, pay attention to the things beyond the decor, like the high ceiling, multiple windows, and more.

If you are adept at seeing beyond decor, you could also get a great deal on a home. For example, you might tour a nice, well-built home with the layout you want, but it’s full of floral wallpaper. Many buyers might be turned away by all the work that removing wallpaper entails, but if you can see beyond it, you could buy the home perhaps for a good price.

Only Visit Homes In Your Price Range

Make it clear to your real estate agent ahead of time that you only want to visit homes in your price range. If you can’t find a home you like, your agent might try to convince you to increase your budget by $10,000-$20,000 so you can get certain features you want in a home.

Our real estate agent tried to get us to agree to this because we wanted a home with at least two bathrooms. At the end of the day, though, we couldn’t find one that fit into our price range, so we’re currently in a home with one bathroom. I’m glad we stayed within budget because it helps our monthly budget stay manageable. In the future, we can always upgrade to a home with more bathrooms.

So, it’s important to stick to your budget, even if you know adding $10,000 more to it will only be a few dollars more per month over a 30-year loan. You want your home to be an asset that grows. If you start out with something you can’t afford, it could become a hindrance. Remember, you can always save your money to update a part of your home or make an addition over time.

Step 8: Submit an Offer

Submitting an offer as a first time home buyer can be an anxiety-ridden experience, especially in a competitive market. This is where your buyer’s agent can be most helpful.

When my husband and I bought our first home, our buyer’s agent told us there were already several offers on the house.

We’d already lost two homes in one week, and we didn’t want to lose this one. So, we went in with a very strong offer of $5,000 over the asking price. We also agreed to let the seller live in the home for 30 days, even though it was inconvenient for us. We included a photo of our family and a note about it being our first home, and believe it or not, we were selected out of five different offers.

I’m not advising you to go $5,000 over asking price, but I am advising to know your market well. If you keep making offers on homes that are being rejected, talk to your agent about ways to avoid that in the future. Be flexible and know that you might not get the home that you consider your dream home. However, there are many beautiful homes on the market, and the right one for you is out there!

If Your Offer is Accepted, the Escrow Process Begins

Once your offer is accepted, the escrow process begins. This means that you won’t get the keys to the house the day after you buy it. It can take 1-2 months to go from an accepted offer to walking over the threshold of your first home.

At the beginning of the escrow process, the buyer will deposit what’s called earnest money into the escrow account, a sign of good faith while the escrow agent reviews all documents related to the sale.

Get a Home Inspection

During the escrow process, you’ll also arrange a home inspection. If something in the house needs to be updated or repaired, you’ll negotiate those repairs during this time period. You’ll also arrange for an appraisal of the house and finalize your financing during this time period.

Keep in mind your lender will not finance a house for more than it’s worth, so if your home appraisal comes back as less than the agreed upon purchase price, you’ll have even more negotiating to do with your seller.

Sometimes, if buyers really want a house, they’ll pay the difference between what a home is worth and their offer. This is not usually recommended, though, especially if you only put 0% down on your home. You don’t want to owe more on your home than it’s worth.

Protect Your Home with Insurance

Lastly, you should get insurance on your home before moving in. In order to save money on home insurance, get multiple quotes from many different insurance companies. Keep in mind that you might get the best savings by using a company you already do business with for your car insurance. Insurance companies like it when you bundle insurance because it means you’re being loyal to them for many different types of insurance.

Step 9: Move In!

Congratulations! You’ve reached the 9th and final step here. You get to move in! Go ahead, break out the dance moves. You’ve earned it.

Because you’ve worked hard as a first time home buyer to assess your finances and buy a house you can afford, here are some tips for ensuring you continue to stay in your home for many years to come.

Have a Robust Emergency Fund

Homeowners should have an emergency fund with at least 3-6 months of living expenses in it. This fund will give you incredible peace of mind. If you lose your job unexpectedly, you now have 3-6 months to find a new job without worrying about losing your home. You can also use the money in this emergency fund for major house repairs you weren’t expecting.

Keep in mind that home repairs don’t include a swanky new bar in your basement. This is for when a pipe bursts or you need to replace your entire hot water heater.

If you are looking for a high interest bank to park your emergency savings (while still providing you easy access to your money), check out our roundup of best savings accounts.

Maintain It Often

I’m looking around my living room right now, and I see plenty of areas that need improvement and paint touch ups. The thing is, I know I need to keep maintenance up over time. I don’t want small issues to turn into big repairs. And, I don’t want to spend thousands of dollars fixing up my house when it’s time to sell.

Properly maintaining your home over time ensures that it can grow in value and by extension, grow your net worth over time.

Avoid Overextending Yourself

Your home is one of the biggest purchases you’ll ever make. And, once you’ve been living there a few years, it’s tempting to use a home equity line of credit to upgrade your kitchen or your bathrooms. However, try to avoid overextending yourself. Protect your investment in your home and be careful about leveraging it to borrow money. Your biggest goal should be to remain a homeowner for as long as possible. Don’t place buying new furniture above paying your mortgage bill. Always protect this big investment by caring for it and ensuring you always pay your mortgage bill on time.

Ultimately, if you stay focused, always make prompt payments, and continue to maintain your home, you’ll be well on your way to building long term wealth through home ownershi – even as a first time home buyer.

Acorns is a simple investing app that helps you grow your savings by putting your money into investments designed to grow in value over time. If you are new to investing and want to get your feet wet, this is a great app to start with.

Acorns is a simple investing app that helps you grow your savings by putting your money into investments designed to grow in value over time. If you are new to investing and want to get your feet wet, this is a great app to start with.